s corp tax calculator nyc

In NYC the GCT is imposed on S corporations at a rate of 885. For example if you.

New York City Taxes A Quick Primer For Businesses

S-corporations are exempt from the Business Corporate Tax but they are still subject to the General Corporation Tax or Banking Corporation Tax.

. This could potentially increase the S-corp tax bill significantly. It cannot be prorated. Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses.

Standard deduction 12400 for 2020 single filers and Section 199A commonly called QBI. This calculator applies the following. Estimated tax must be either.

Be sure to add all your details in the more. For example in New York City an S-corp would be subject to the citys 885 business tax on top of state and federal taxes. This rate 153 is a total of 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance.

The corporations ENI tax rate will depend on the amount of the corporations federal taxable income. This application calculates the federal income tax of the founders and company the California state franchise tax and fees the self-employment tax for LLCs and S-Corps pass-through. For tax years beginning in or before 2008 a minimum tax of 300.

Here are few considerations when forming an S. Tax underpayments will have interest applied to them daily. Publicly traded partnerships that were.

The rates below apply to tax underpayments of income and excise taxes including. The SE tax rate for business owners is 153 tax. For tax years beginning in or.

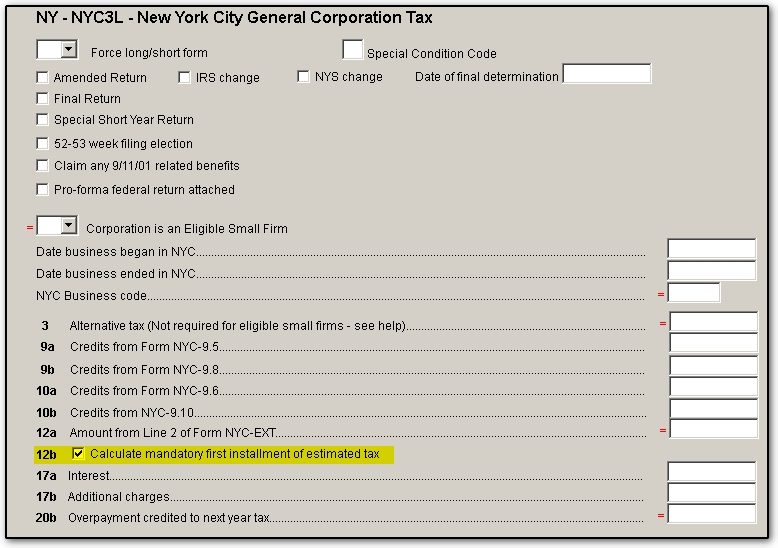

After the formation of the corporation in New York you need to apply for S corporation with the state and federal tax departments. There are four methods for determining GCT in New York. General Corporation Tax GCT.

Generally corporations operating in New York incur a tax rate of 65 percent if their. S Corps in NYC. See TSB-M-15 7C 6I for additional.

Beginning after 2014 the business income base is the primary tax base for corporations. The method that produces the largest amount of tax will be imposed. A payment of 25 of the tax liability for the preceding year is required as the first installment of estimated tax for the current year.

See S corporations - tax years beginning before January 1 2015 for S corporation information for years prior to corporate tax reform. Line 22 - Federal Taxable IncomeCalculate the value of Part I Line 14 minus Part II Line 21 and enter here and on Schedule B Line 1 of your form NYC-1 NYC-3L NYC-4S or NYC-4SEZ. Not less than 90 of the tax.

These methods are as follows. If a return is filed for a period of less than one year the tax is still 300.

Ny State And City Payment Frequently Asked Questions

New York City Taxes A Quick Primer For Businesses

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Nyc Mansion Tax Of 1 To 3 9 2022 Overview And Faq Hauseit

Right Of First Refusal Work In Nyc Hauseit Right Of First Refusal Buying A Condo Nyc

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

/taxes_in_new_york_for_small_businesses_the_basics-5bfc3575c9e77c005145c81b.jpg)

Taxes In New York For Small Business The Basics

Co Op Maintenance Tax Deduction Calculator Interactive Hauseit

A Frozen Bank Account Is A Bank Account That You Cannot Access Because A Creditor Has Placed A Restraint On Student Information Credit Card Online Bank Account

Pin By Dan Young On Utah Katie Equity Real Estate Buying A New Home Local Real Estate Home Ownership

The Impact Of Hybrid Work On Commuters And Nyc Sales Tax Office Of The New York City Comptroller Brad Lander

World S Richest Cities The Top 10 Cities Billionaires Call Home 2020

What Is The Basic Star Property Tax Credit In Nyc Hauseit

Nyc Buyer Closing Cost Calculator Interactive Hauseit

New York State Enacts Tax Increases In Budget Grant Thornton